Beginner's guide

The Ultimate Guide to Bitget Copy Trading

Beginner

2022-08-31 | 5m

As the global crypto exchange whose core mission is to transform the way people trade and motivate them to embrace crypto accordingly, Bitget is proud to be the first to bring copy trading to crypto since 2020.

Bitget Copy Trade is designed to be a powerful and practical tool for any trader, be it an absolute beginner or a veteran, and this is the one and only guide you need to kickstart your copy trading journey with Bitget!

What Is Bitget Copy Trade And Why Choose Us

Bitget’s flagship product,

Bitget Copy Trade, applies the principles of

Social Trading to help traders connect with their experienced fellows and learn their success secrets. Any Bitget user can choose an expert trader to follow, hence become a

Follower, and automatically copy all orders that particular trader makes. This way Bitget Copy Trade provides a transparent and reliable trading environment where both professional traders and beginners can help each other generate more income cooperatively.

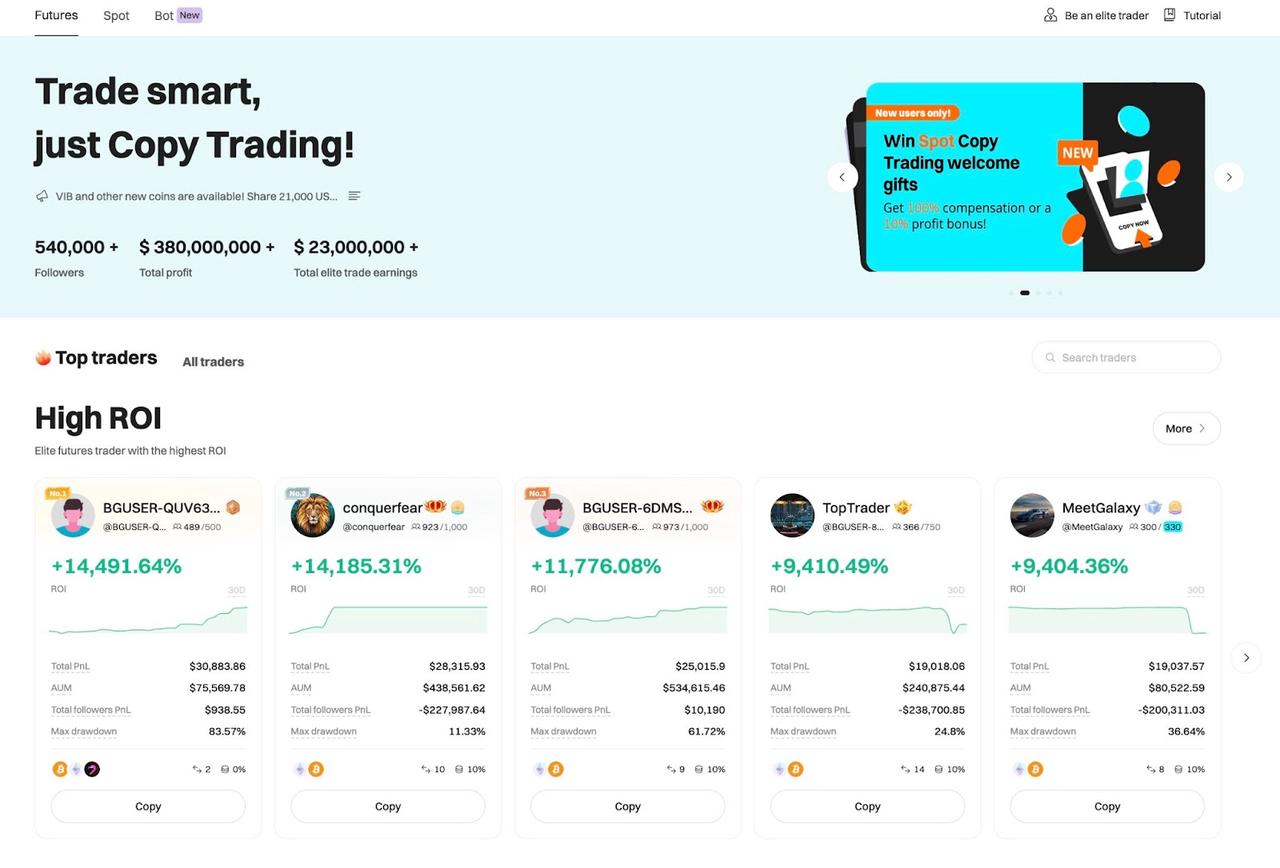

To date, Bitget is the world’s largest crypto copy trading platform with a network of over 110,000 traders and 540,000 followers. Combined, they have completed a total of more than 100 million trades since the inception of Bitget Copy Trade.

We offer

futures copy trade,

spot copy trade, and

bot copy trade to give our users more trading options.

It’s important to note that Bitget is a leader in liquidity, security, and compliance. We are the

only crypto exchange to achieve an increase in its derivatives volume six months post-FTX, among the few exchanges with no record of security breach - a direct result of holistic security strategy, a team of dedicated pioneers who make every effort to adhere to local regulations to conduct uninterrupted operations across the globe. In addition, Bitget was the first and only one to introduce a US$200 million

Bitget Protection Fund back in July 2022, whose value has already increased to US$300 million, as well as the first and only one to partner with the decentralized data warehousing service provider Space and Time (SxT) to provide a verifiably tamperproof audit trail of data and computation.

How To Use Bitget Copy Trading: Followers’ Guide

There are three main steps to use Bitget Copy Trade as a follower:

Create a new Bitget account (if you don't have one yet) - choose the trader to follow - click on ‘Copy’ and confirm it.

Please note that the process remains the same for spot and futures copy trade. However, we want to give you some useful tips that could help make the process even easier for beginners. Let's get right into them.

Selecting the best trader(s)

If you already make a list of good traders and want to select the best out of them, we have the right tool for you here:

Elite traders comparison. This feature allows for a general comparison of several traders at the same time based on their basic information, trading data and insights activities.

However, you can also find your best match by filtering through the overall ranking, ROI, AUM, etc. on the homepage for both Bitget

Futures and

Spot Copy Trading.

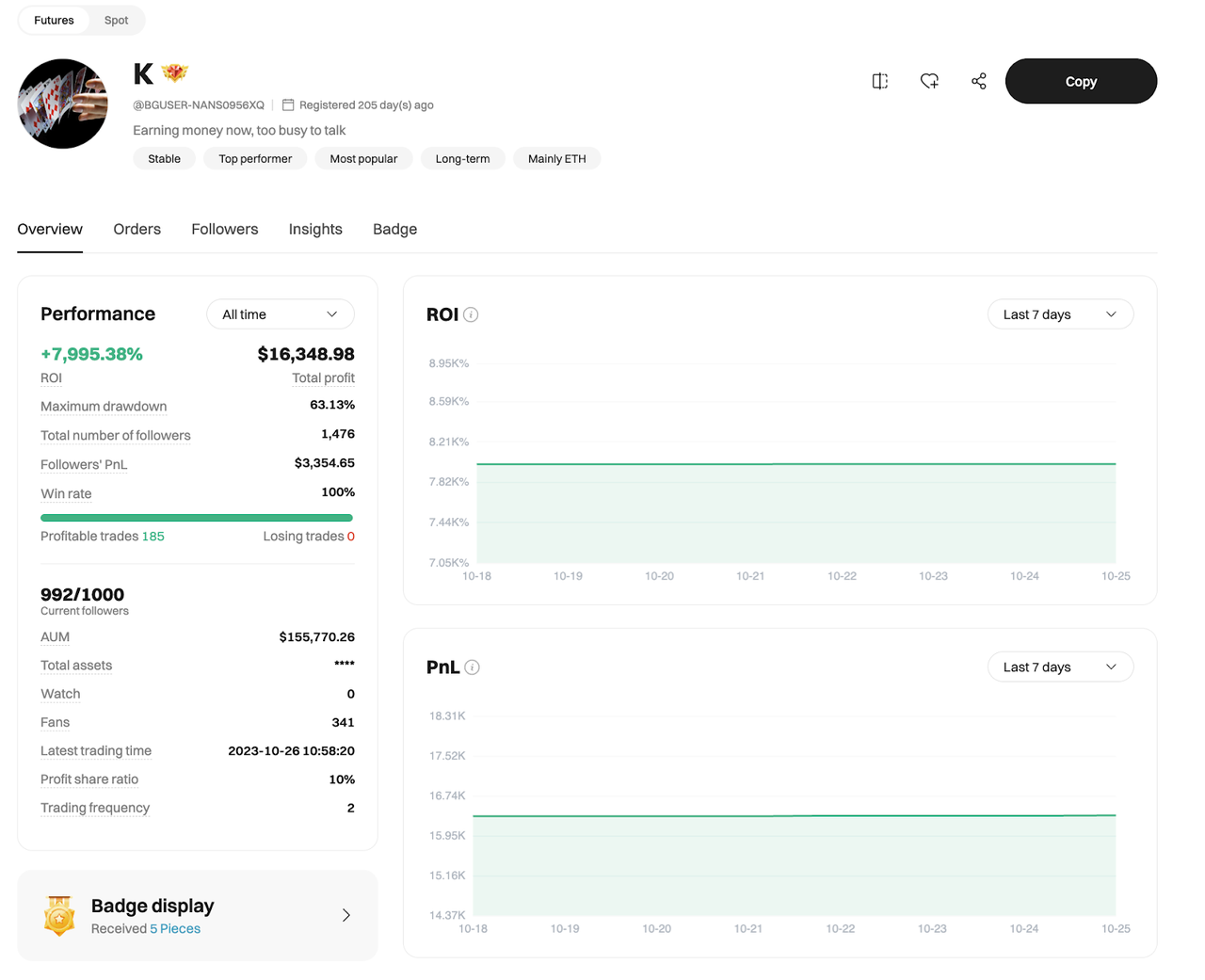

When you see one fitting trader, click on their profile to further review their success metrics like this:

Performance includes all the numbers you've seen on the homepage (ROI, Maximum drawdown, Total

copy traders, Total profit, Win rate, AUM), whereas

Copy trade order shows all the futures contracts enabled for copy trading by this trader.

Under the

Orders tab, you can find the list of one trader's historical trades and

copy trades, and details of their followers are provided in the

Followers tab.

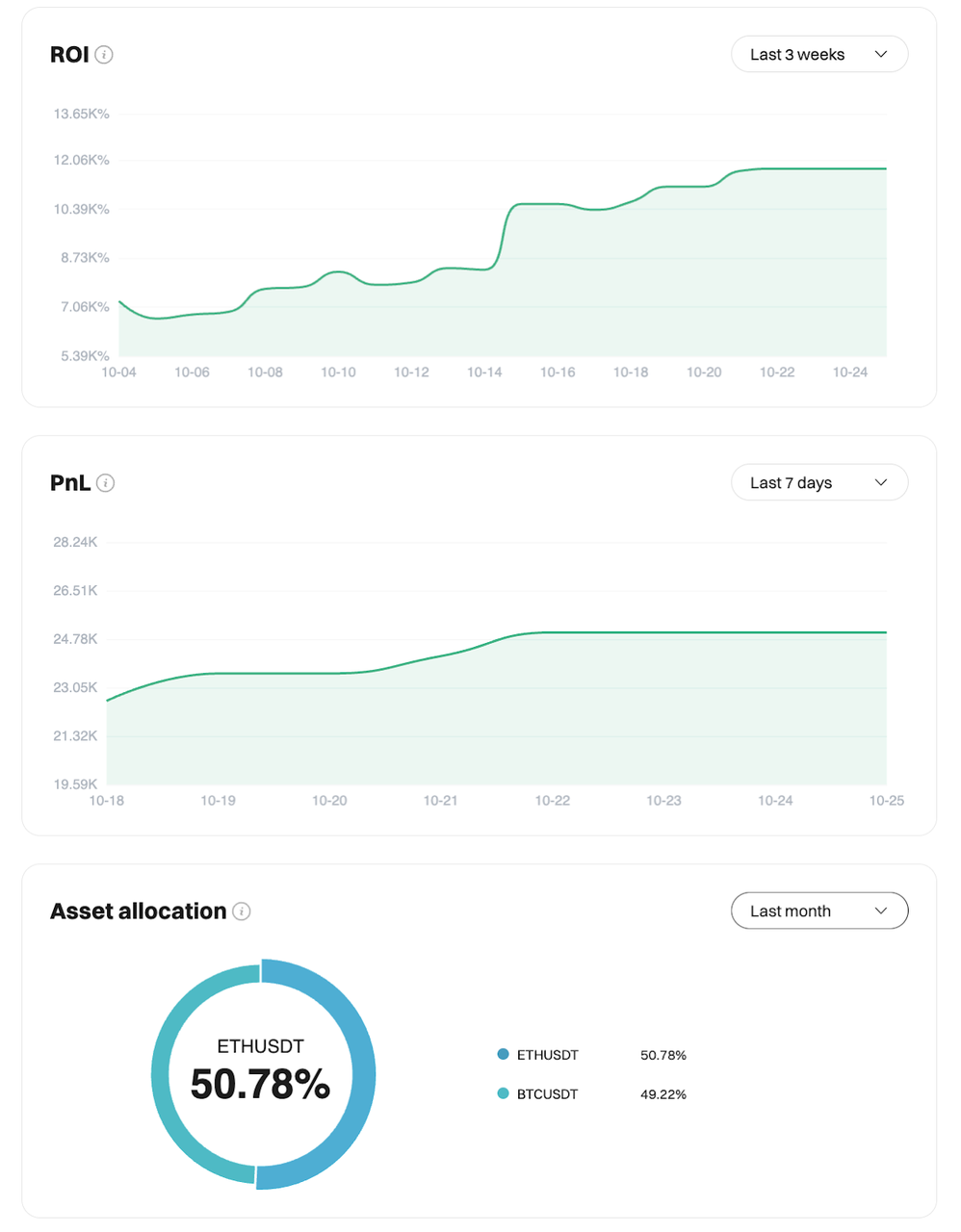

Now moving on to the

Analysis. Key metrics are visualized to provide a digestible summary of a trader's activities in 24 hours, 7 days, 3 weeks, one month, or six months. If the

Performance is more of a general overview,

Analysis illustrates changes over time and gives insights into the trader's strategy.

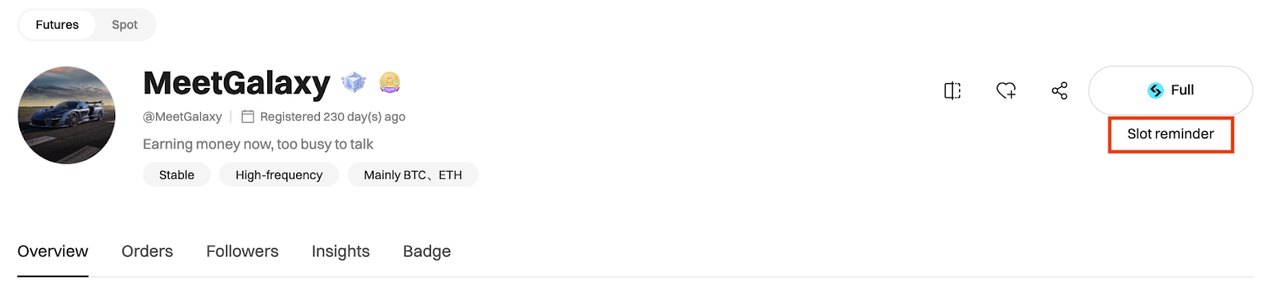

If the follower capacity of the trader you wish to follow is already full, you can hit on the ‘

Slot reminder’ button, the system will notify you as soon as someone unfollows this particular trader.

Setting your preferences

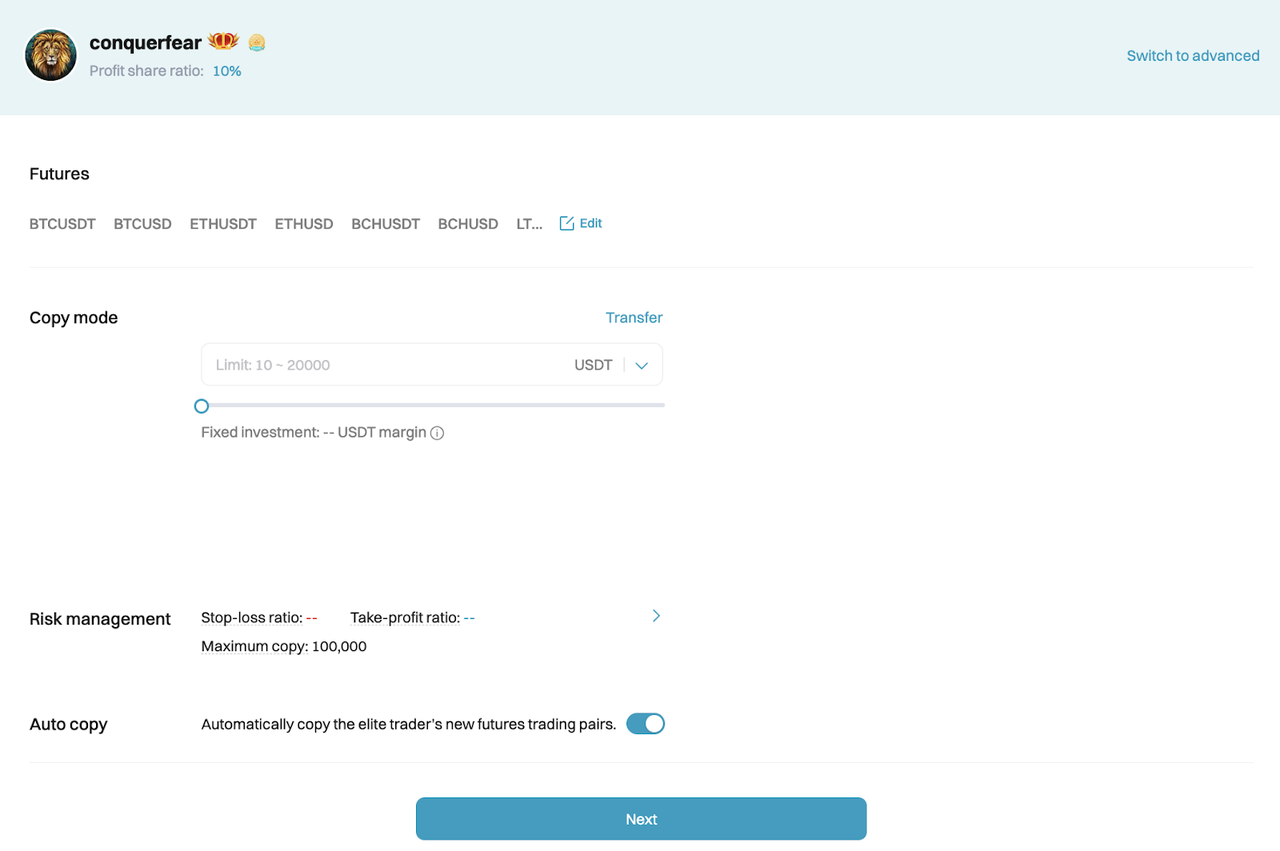

When you click on the

Copy button next to a trader's profile, it'll show a message box as below:

(1) Profit share ratio: This shows how much of your profits the trader shares.

(2) Futures: By default, a follower is exposed to all the futures contract (in case of Futures Copy Trading) or all the trading pairs (in case of Spot Copy Trading) the trader has enabled. If you wish to trade a set of preferred contracts only, click on

Edit and unselect those that don't fit.

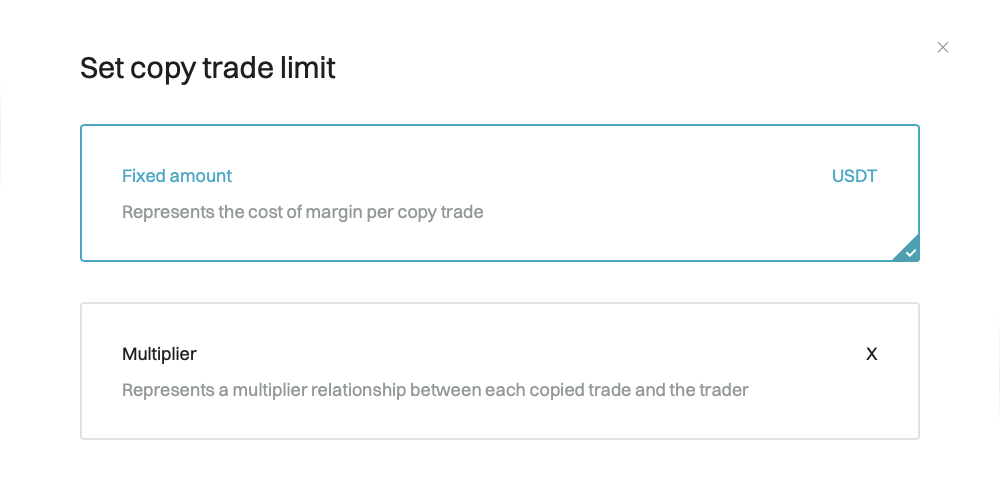

(3) Copy mode: Click on the dropdown menu and choose the most suitable copy mode.

With

Fixed amount, you allocate a pre-set amount of equity, for example 500 USDT for each trade undependable of the trader's position value. In many cases, it's better to choose

Multiplier because it creates a synchronisation between a trader and the follower(s), which helps avoid any mismatch during the implementation of the trader's strategy and unwanted risks.

Let's take an example: Assume the trader has 3,000 USDT in equity and they decide to split it equally into 10 trades, meaning each trade has 300 USDT as initial margin. A follower of them has 2,000 USDT in their Futures account, selects the

Fixed amount mode and allocates 500 USDT for every trade. If the trader uses Cross Margin for all of their trades, a losing one can be covered by the remaining equity which makes up to 2,700 USDT. Meanwhile, the follower has only 1,500 USDT ready to compensate for the same position and takes a higher risk of liquidation.

Should this follower select the

Multiplier mode to allocate an amount of equity proportionally to their trader, they need to enter 0.67 (2,000 / 3,000 = 0.67) as the ratio between their equity and that of the trader. Then the same position would require an initial margin of only 200 USDT, so there's 1,800 USDT available for compensation. If they have 6,000 USDT in their Futures account, the recommended multiplier is 6,000 / 3,000 = 2.

Our advice: It's best to take advantage of the data and charts available in each trader's profile to understand their trading strategy before filling in your follower's settings.

Managing your trades

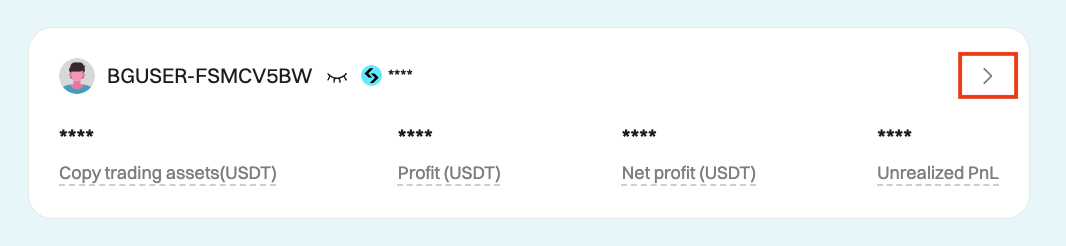

On the homepage (

here for Futures Copy Trading and

here for Spot Copy Trading), click on the [Arrow] symbol to review all your trades and positions.

Once you get the list of all your trades and positions like this, you can manually close one position by clicking

Close under

Action or click on

Close all positions.

How To Use Bitget Copy Trading: Traders’ Guide

If you are an experienced trader who is looking for a new stream of passive income, apply today to become a

futures trader or a

spot trader on Bitget Copy Trade! It’s

the platform for you to showcase your skills and earn from your followers’ success. After successful application, you’ll want to execute the first trade for your followers and followers-to-be to copy.

Trader application requirements

(1) Application requirements:

• You have absolutely no open positions, open orders and/or trigger orders in any of your futures accounts (the unified Futures account, the Isolated Margin account(s) and the demo account);

• You are not following any trader at the time of application;

• You can only register one account as a trader for Bitget Copy Trade.

(2) Deposit requirements: We have a tiered follower system that is consistent with the amount of equity (in USDT) in traders’ accounts as follows:

• For futures traders:

|

Total equity in futures account (USDT, rounded down)

|

Maximum number of followers

|

|

0 - 499

|

0

|

|

500 - 999

|

100

|

|

1,000 - 4,999

|

300

|

|

More than 5,000

|

500

|

• For spot traders:

|

Total equity in spot account (USDT, rounded down)

|

Maximum number of followers

|

|

0 - 99

|

0

|

|

100 - 999

|

100

|

|

1,000 - 4,999

|

300

|

|

More than 5,000

|

500

|

Once the number of your followers has reached the maximum target, you’ll automatically receive an additional 10% of your current limit.

If your account balance declines and pushes you down the lower tier, all your current followers won’t be affected. They are still able to copy any of your new trades and orders. However, if any of them decide to unfollow you, they won’t be able to follow you again unless you deposit more equity into your account or until you have fewer followers than the current tier’s limit.

(3) Trader List requirements:

• Only when your futures account balance remains above 500 USDT or your spot account balance above 100 USDT will you be displayed on the Trader List of Bitget One-Click Copy Trade. Please remember to update your account balance regularly, as our Trader List is updated every hour; • You have to already complete at least one order supported by the platform;

• Your followers won’t be affected if you no longer appear on the list; it’s to give you exposure to the community.

Profit sharing scheme

As a trader on Bitget Copy Trade, you can share up to 10% of your followers’ profits. This is a summary of the profit-sharing scheme for traders:

|

The amount of BGB locked

|

Copy Trade Profit Rebate

|

|

1,000 BGB

|

4%

|

|

2,000 BGB

|

6%

|

|

3,000 BGB

|

8%

|

|

4,000 BGB

|

10%

|

This number will appear on the trader's profile when a user decides to follow them. We believe that this win-win strategy will encourage traders to constantly improve their strategies, thereby unlocking even more earning opportunities in the future. Owning BGB is also extremely advantageous, because the value of BGB is derived from the flourishing of Bitget, which can be dictated by you; your contributions as a thriving trader will in turn help grow

BGB prices substantially and benefit you in the long term. Moreover, being recognised as a trader on Bitget Copy Trade is equivalent to a KOL exposed to our network of 20 million users worldwide - take advantage of it and make trading even more profitable!

Elite trader tiers

To boost traders’ motivation and encourage better performance, we have introduced the

Bitget elite trader tiering system with six tiers of Bronze, Silver, Gold, Platinum, Extraordinary and Legend. The higher the tier, the more perks and benefits traders will receive.

Accompanied Bitget One-Click Bitget Copy Trade are

Bitget Academy and

Bitget Insights. The former is the only crypto knowledge bank you’ll ever need, whereas the latter keeps you informed of the general market sentiment and serves as a gold mine of insightful expert opinions. Empower yourself with Bitget - we are your trusted companion on your crypto journey!

Share

How to buy BTCBitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade nowWe offer all of your favorite coins!

Buy, hold, and sell popular cryptocurrencies such as BTC, ETH, SOL, DOGE, SHIB, PEPE, the list goes on. Register and trade to receive a 6200 USDT new user gift package!

Trade now