Beginner's guide

The Complete Guide to USDT-Margined Futures on Bitget

Beginner

2022-07-09 | 5m

Designed to give our users the best trading experience, Bitget USDT-Ⓜ

Futures is the most beginner-friendly crypto derivatives product.

Margin Trading: What is it?

Margin Trading allows traders to engage in futures trading activities without having a lot of cash at hand. You’ll need to deposit a particular amount based on the contract value to start with; the rest can be borrowed for an amplification effect, i.e., increasing buying power.

Margin trading encourages traders to reevaluate their positions on a daily basis: traders whose account balance falls below a required amount will have to pay up for their uncovered exposure as fast as possible, or else the exchange can close out any open positions until the account balance meets the minimum value. Traders can also voluntarily exit some less favourable positions instead of depositing more equity into their accounts.

Perpetual Contracts

Futures contracts on Bitget are mostly perpetual, meaning they do not have a concrete expiry date. It is completely up to traders how long they want to hold the contract. Hence, markets are impressively liquid (entrance and exit made easy at very low costs). Moreover, perpetual contracts are written on an asset’s index price, which equals the average price of that particular asset with respect to its spot price and trading volume.

Funding Rate

Funding Rate is a crypto-specific term. As perpetual contracts have no expiry, profits and losses cannot be calculated in the same way as normal futures contracts. Fund Fees on Bitget are traders’ profits/losses, updated and realised every 8 hours based on the price difference between perpetual market and spot market. Bitget does not charge this fee; it is paid into winning accounts with funds taken from losing accounts, depending on the open positions. Real-time funding rates as well as historical data can be found

here.

Important terms you’ll come across

There are some significant terms related to margin trading that will help you get acquainted with the process faster as belows:

Types of Margin

The five different types of margin on Bitget include Initial margin, Maintenance margin, Variation margin, Available margin, and Risk margin.

Initial margin is the bare minimum amount of equity that needs depositing before you can open any position, which plays the role of a guarantee for the counterparty.

Maintenance margin is the minimum amount of equity to be maintained in the account during the life of each contract and is always lower than the initial margin.

Variation margin is the difference between the initial margin and the current (margin) balance and is to be calculated in case of a margin call, i.e. when the account balance falls below the required maintenance margin. Our users will see

available margin as the total amount of equity available for placing new trades.

Risk margin appears to be the most complicated out of these five. It represents the actual delivery obligations one trader has. Consider the following example: John wants to long 5 BTC on Bitget because the conditions are favourable. However, due to high volatility, he also tries to offset this long position by taking a short position of 2 BTC and consequently reducing his obligations of delivering all 5 BTC in case prices drop. Consequently, the maximum amount of BTC to be delivered when BTC prices decrease is 3 BTC, reflecting the maximum level of John’s risk margin.

Modes of Margin

As a leading derivatives exchange in the crypto space, Bitget makes both Isolated Margin mode and Cross Margin mode available for all users.

In the

Isolated Margin mode, each position will be allotted a specific margin and, correspondingly, an independent Isolated Margin account. The initial margin for Isolated Margin accounts is completely separated from each other and from the available margin. This option encourages traders to proactively manage their individual positions and is designed for highly speculative trading, as the maximum loss possible is restricted to the Isolated Margin balance only.

Cross Margin means all positions can have access to one joint margin pool, meaning traders can tap into all available equities in their margin account. Please note that with cross margin on Bitget, one trader may have several margin pools of different cryptocurrencies. Only open positions with the same settlement (crypto-)currency can make use of the corresponding joint pool.

Trading USDT-Margined Futures on Bitget

Supported trading pairs

There are nearly 200 margin trading pairs available on Bitget, with the maximum leverage levels being as high as 125X for

BTCUSDT,

XRPUSDT, and 100X for

ETHUSDT. New trading pairs are added on a weekly basis.

For

USDT-Ⓜ Futures, profits and losses will be settled in USDT.

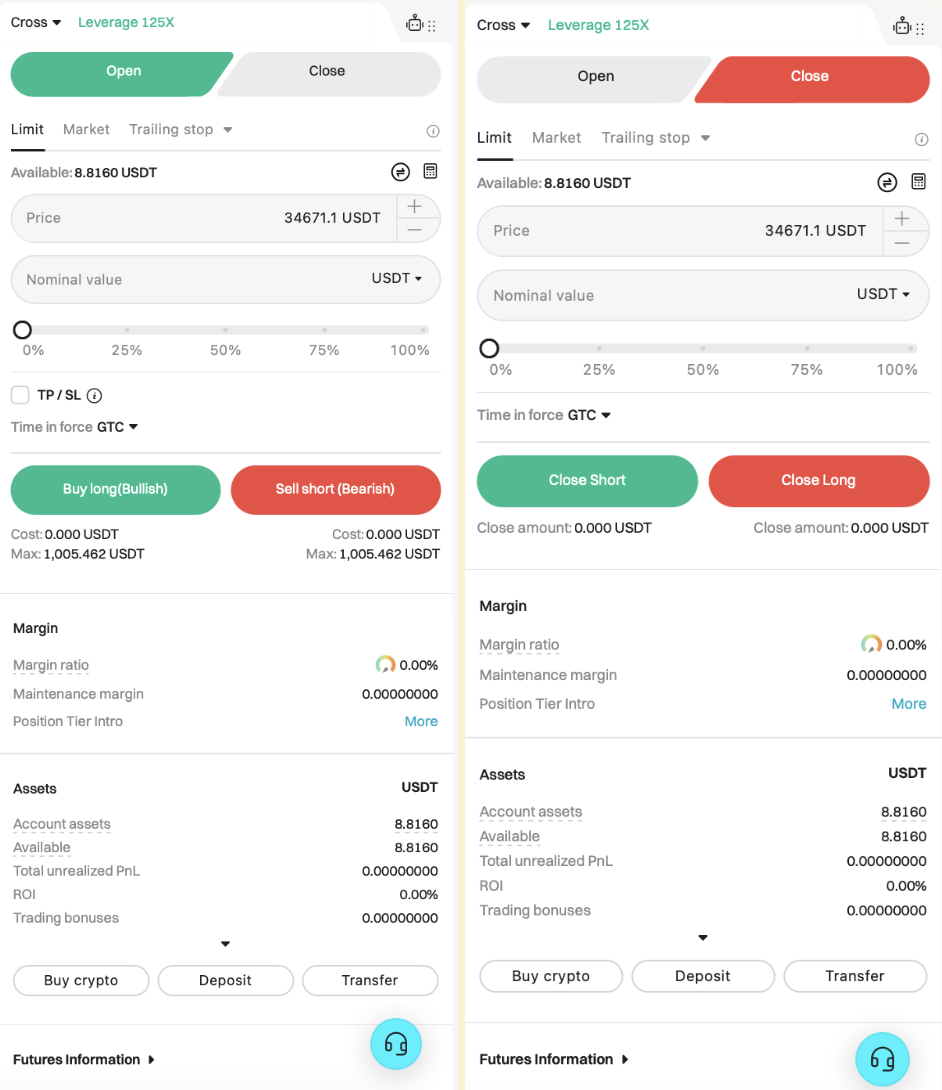

Bitget USDT-Ⓜ Futures: Step-by-step tutorial

Trading crypto futures has never been easier with Bitget. The basic steps can be summarised as such:

1. Go to Bitget USDT-Ⓜ Futures trading page and log in with your Bitget account. Not yet a Bitget user? Sign up now!

2. Click on 'Transfer' under the 'Assets' page to transfer funds from your Spot account to your USDT-Ⓜ Futures account. There is no fee incurred for internal transfers.

3. Start trading by opening a new position.

You’ll choose one favourite trading pair, your mode of margin, preferred level of leverage, together with price, number and direction (long/short) of contracts.

Submitted and processed orders will be shown under

Open Orders. When they are successfully submitted, you can find them under

Positions, where you can deliberately adjust the leverage or close the position when needed.

-

Check profits and losses (P/L): Also displayed under Positions, profits and losses are divided into two categories of unrealised (not yet received/taken at marked price) and realised P/L. If the position is already closed, P/L is shown under Trade Details.

-

Close the position: You can manually close or reduce any existing position by entering the details as shown below. Please note that closing orders can not be revoked.

-

Similar to opening positions, processed closing orders will be available for check-up in Open Orders.

Leverage and risk management

Bitget encourages our users to trade responsibly and mindfully with the help of risk management strategies and our applied functionalities.

One unique feature of Bitget is profits and losses are settled on a real-time basis. That also represents our guarantee for a sophisticated, accurate data system. Traders will be able to manage their account commensurate with the market.

Bitget users can also switch between Cross Margin and Isolated Margin mode at will to better improve their portfolio performance as well as reducing the risk of liquidations.

In case of a margin call, traders have to meet the initial margin requirements in a particular time period to maintain their open positions, otherwise traders will be forced into liquidation, i.e. closing out open positions, until their current account balance satisfies the initial margin requirements for the remaining positions:

-

Forced liquidation in Isolated Margin mode: At 100% margin ratio, a position will be forced into liquidation if isolated account balance + unrealised P/L in isolated mode < maintenance margin.

-

Forced liquidation in Cross Margin mode: At 100% margin ratio, a position will be forced into liquidation if cross account balance, excluding isolated margin and unrealised P/L in isolated mode, is less than the maintenance margin.

If such a case is to take place, Bitget users can conveniently choose between the following actions to minimise loss(es):

(1) Cancel the order: For the isolated margin mode, it only cancels the opening and closing orders of this transaction for one position at a time. For the cross margin mode, all orders for opening and closing positions will be cancelled (including positions in the isolated margin mode).

(2) Remove the hedge position order of all trading pairs (isolated margin mode not included);

(3) Deleverage: Reduce 2 leverage levels each time (isolated margin mode not included).

Please note that if risk treatments are being applied, other operations will be prohibited until the process is completed.

Why Choose Bitget’s USDT-Margined Futures?

Officially recognised as a leader in the crypto derivatives market in terms of liquidity and global open interest, Bitget aims to lower both the entry barriers to crypto and the threshold to contract trading. Our product design philosophy is solely based on perfecting the customer experience; these efforts have been handsomely rewarded with 20 million loyal users from over 100 countries and regions.

-

Nearly 200 trading pairs and counting, with a maximum leverage of 125X

-

Top 3 global derivatives liquidity

-

Top 3 global exchanges in terms of volume with a daily derivatives trading volume of US$10 billion according to CoinMarketCap, Coingecko, and Coinglass.

-

Industry-leading security: Bitget’s major advantage lies in the unique blend of security, margining system and competitive trading fees. Bitget has received 12 A+ ratings from SSL Labs, a built-in DPI active defence system, and a self-developed wallet warning system and it’s backed by top-notch security companies such as Suntwin Technology, Armors, HEAP, and others. In addition, Crypto Exchange Ranks (CER) has listed Bitget as one of the top 10 exchanges by Cybersecurity - an acknowledgment for our efforts to effectively safeguard our users’ funds over the past four years.

-

24/7 global and multilingual customer support: you can ask for help at any time, we are always there!

-

Dedicated demo trading environment for beginners to learn how to trade with zero risks.

Get ready?

Sign up for a Bitget Futures account and explore the world of crypto derivatives trading now!

Share

How to buy BTCBitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade nowWe offer all of your favorite coins!

Buy, hold, and sell popular cryptocurrencies such as BTC, ETH, SOL, DOGE, SHIB, PEPE, the list goes on. Register and trade to receive a 6200 USDT new user gift package!

Trade now